massachusetts estate tax table

However for most individuals who have assets between 1M and 5M then the tax rate hovers anywhere from 0 to 20. Form M-4422 Application for Certificate Releasing Massachusetts Estate Tax Lien and Guidelines.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Massachusetts estate tax is a transfer tax imposed on the value of all property in the estate of a decedent at the date of death and not on the value of property received by each beneficiary.

. Massachusetts Estate Tax Rates. Massachusetts estate tax table. 4 5 The term adjusted taxable estate means the taxable estate reduced by 60000 per Internal Revenue Code 2011b.

The Massachusetts State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Massachusetts State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Wife is now over the threshold by 2 million and owes a Massachusetts estate tax of around 182000. By Posted in edge to edge screen protector vs regular.

Example - 5500000 Taxable Estate - Tax Calc. The Massachusetts tax is different from the federal estate tax which is imposed only on estates worth more. If youre responsible for the estate of someone who died you may need to file an estate tax return.

This type of planning is the most common method of reducing or eliminating estate taxes. Was enacted in 1975 and is applicable to all estates of decedents dying on or after January 1 1976. Your estate will only attract the 0 tax rate if its valued at 40000 and below.

A properly crafted estate plan may. If youre a resident of Massachusetts and leave behind more than 1 million for deaths occurring in 2022 your estate might have to pay Massachusetts estate tax. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

The Massachusetts estate tax for a resident decedent generally is the Credit for State Death Taxes number shown on Line 15 of the July 1999 Form 706 see Form M-706 Part 1. April 1 2014 to. 402800 55200 5500000-504000046000012 Tax of 458000.

US Estate Tax Return Form 706 Rev. Massachusetts Tax Forms 2020 Printable State Ma Form 1 And Instructions. An estate valued at 1 million will pay about 36500.

The Massachusetts estate tax is calculated by. The New York estate tax exemption which was 1000000 through March 31 2014 was increased as follows. Masuzi July 19 2018 Uncategorized Leave a comment 8 Views.

Massachusetts Estate Tax Houlihan and Muldoon Attorneys At Law One Adams Place 859 Willard Street Quincy MA 02169 Phone 617 328-0085 Email. This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed. Download Or Email M-706 More Fillable Forms Register and Subscribe Now.

What To Know About The 2020 Estate Tax Exemption In Massachusetts Ladimer Law Office Pc. The adjusted taxable estate used in determining the allowable credit for state death taxes in the table is the federal taxable estate total federal gross estate minus allowable federal deductions less 60000. The Massachusetts Department of Revenue is responsible.

December 31 2000 see Massachusetts Estate Tax Return Form M-706. Note that the above estate values are given after administrative and estate expenses. Why More States Are Killing Estate Ta Familywealth 17.

Unless specifically stated this calculator does not estimate separate estate or inheritance taxes which are levied in many states. The filing threshold for 2022 is 12060000. Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16.

Form 706 July 1999 revision. The Massachusetts Estate Tax applies to individuals with assets worth over 1 Million and the tax rate varies. In the administration of an estate there are many services that the personal representative formerly.

Massachusetts gives executors and caretakers of the estate nine months to file this. State By Estate And Inheritance Tax Rates Everplans. Connecticut S Estate Tax.

Massachusetts Estate Tax Table 2017. Only to be used prior to the due date of the M-706 or on a valid Extension. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional.

Under the table the tax on 840000 is 27600. Killing estate ta estate ta or inheritance tax debate massachusetts estate and gift ta. Massachusetts Department of Revenue has issued directive pursuant to which separate Massachusetts QTIP election can be made when applying states new estate tax based upon pre-EGTRRA federal state death tax credit.

The total Massachusetts estate tax due on his estate would be 280400 or 238800 41600 104 of 400000 the amount of the estate over 3540000. Any Massachusetts resident who has an estate valued at more than 1 million between property and adjusted taxable gifts is required to file a Massachusetts estate tax return. Thoughtful estate planning is very important especially for those that wish to leave assets to their beneficiaries or heirs without being impacted by significant taxes.

If a person is subject to both the Federal and State tax then their marginal estate tax rate could be 45 or more. A guide to estate taxes Mass Department of Revenue. Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect on December 31 2000.

3 900000 - 60000 840000. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Staple check here language removed from form Form M-4768 Massachusetts Estate Tax Extension Application.

If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. The rate ranges from 8 to 16. The same rule applies to nonresidents who owned property in the state.

The Massachusetts estate tax law MGL.

Is Ab Trust Planning Still Effective

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

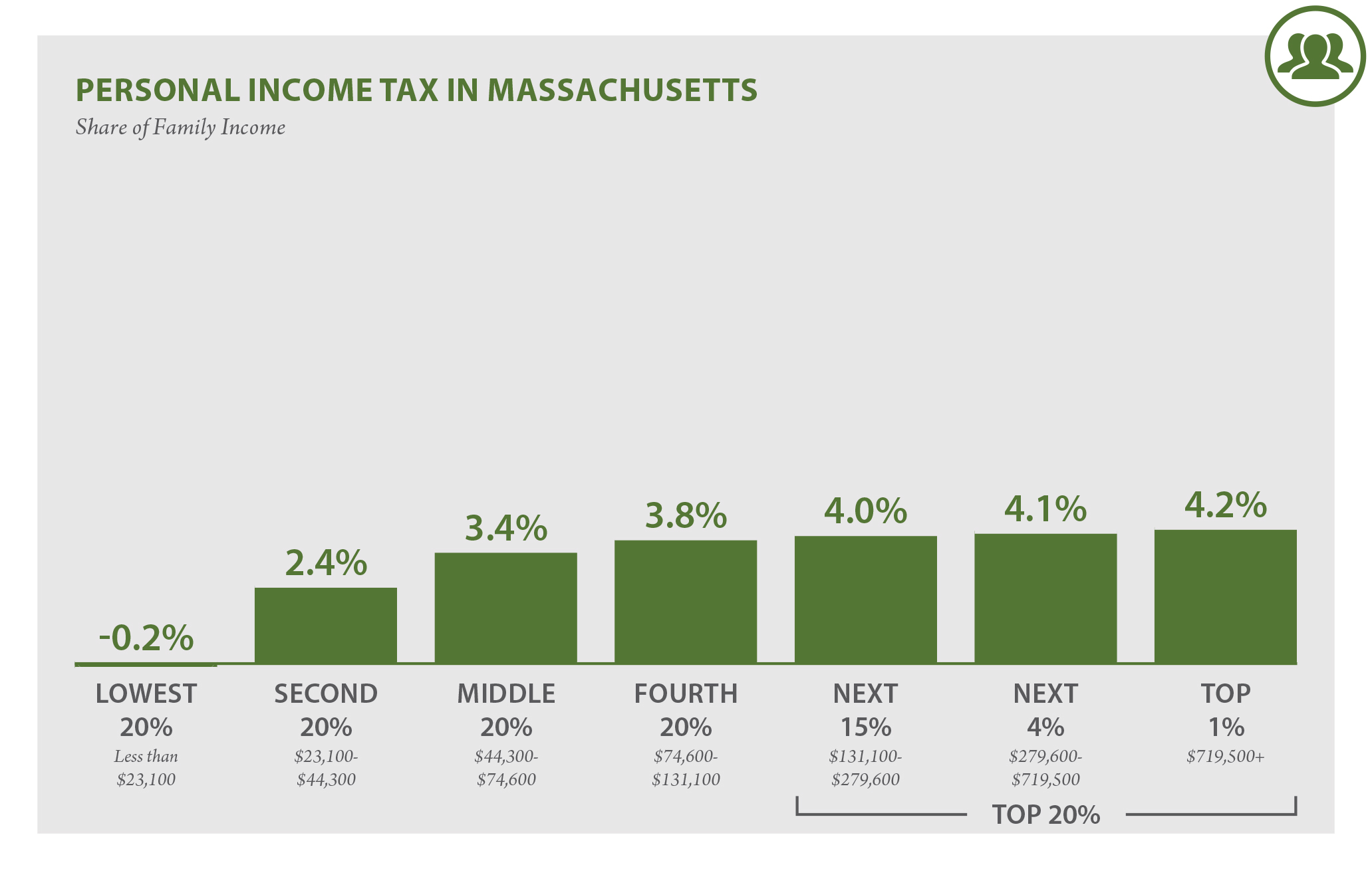

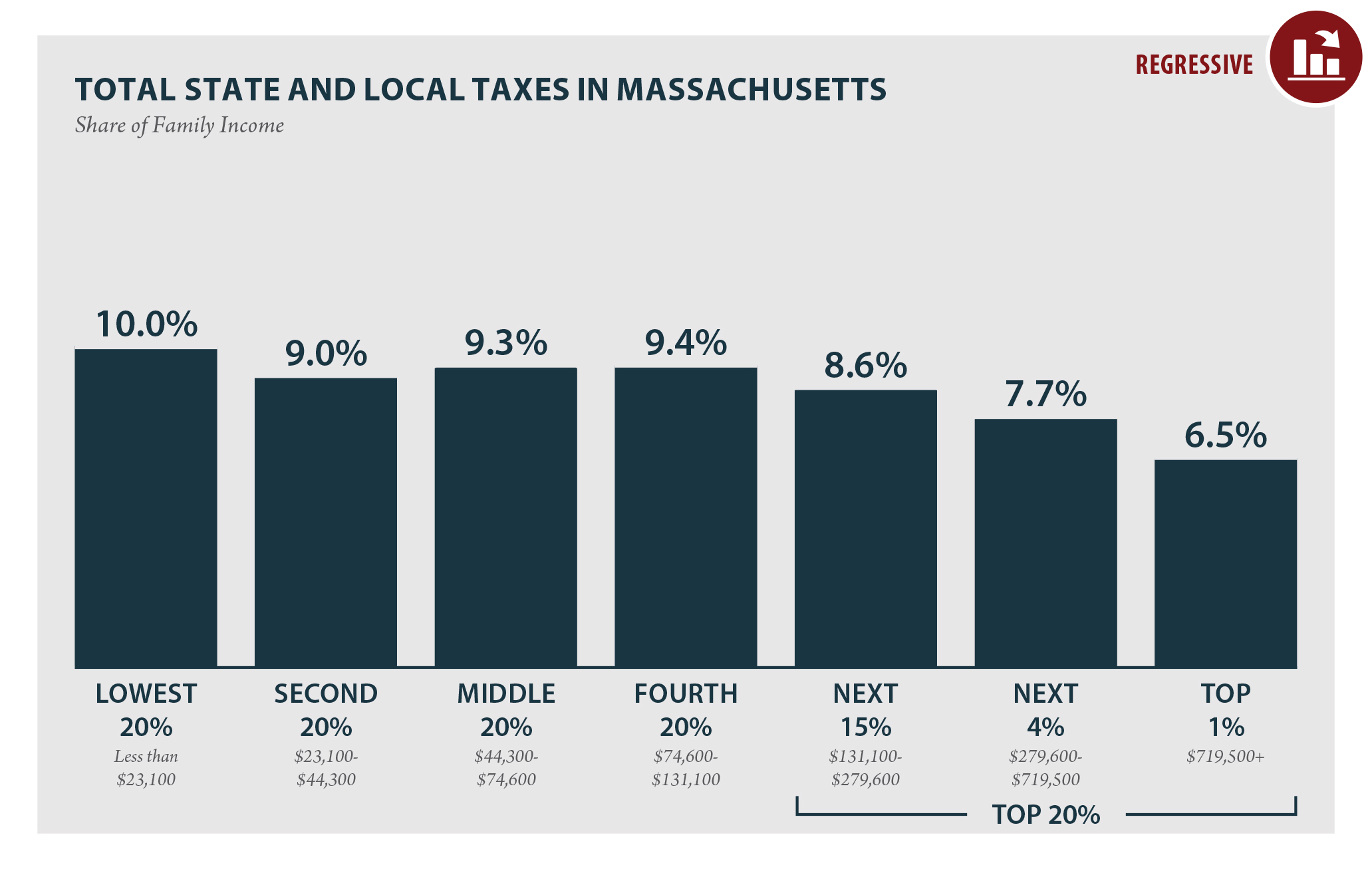

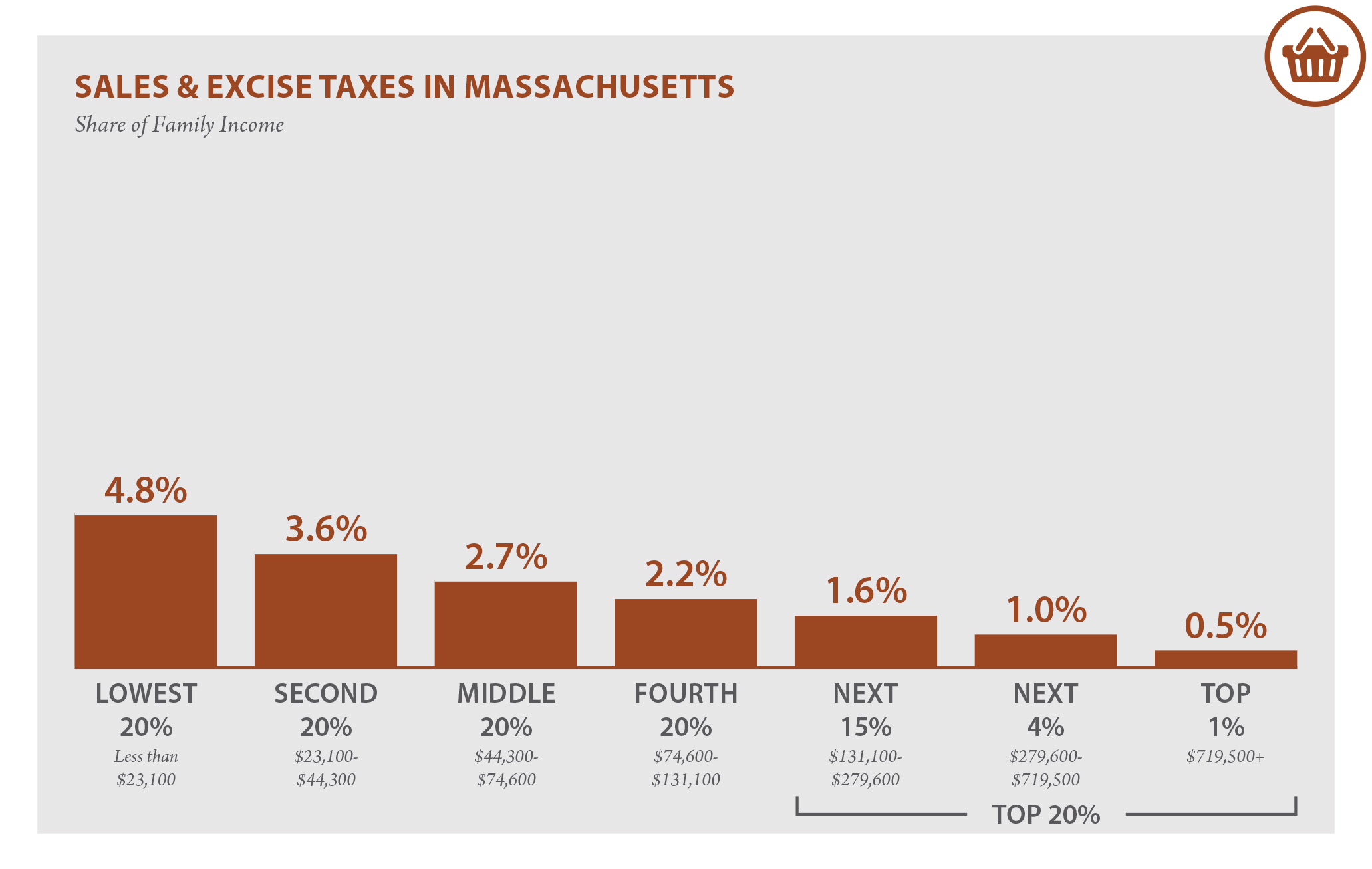

Massachusetts Who Pays 6th Edition Itep

What Is An Estate Tax Napkin Finance

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Massachusetts Who Pays 6th Edition Itep

How Is Tax Liability Calculated Common Tax Questions Answered

Massachusetts State 2022 Taxes Forbes Advisor

How Do State And Local Sales Taxes Work Tax Policy Center

Massachusetts Who Pays 6th Edition Itep

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Massachusetts Estate And Gift Taxes Explained Wealth Management

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Massachusetts Who Pays 6th Edition Itep

Breaking Down The Oregon Estate Tax Southwest Portland Law Group