missouri vendor no tax due certificate

Order may be required for payment before a certificate of vendor no tax due can be issued. The fax number is 573 522-1265.

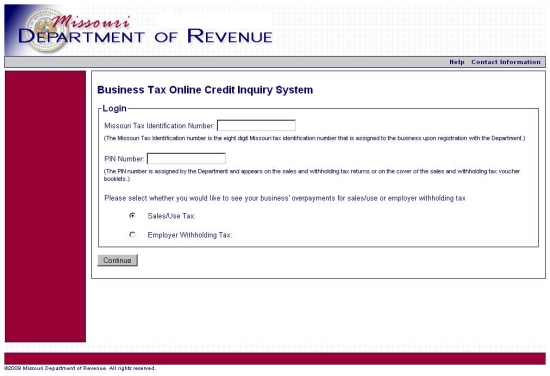

Sales Use Tax Credit Inquiry Instructions

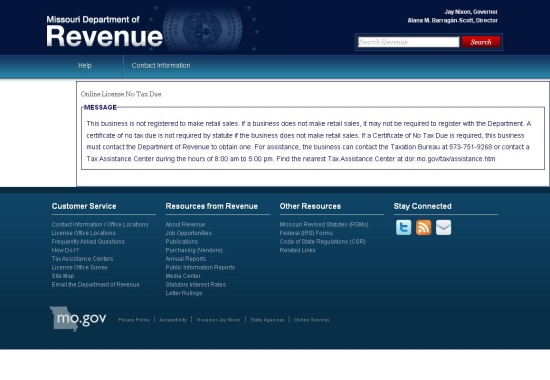

If a business license is not required submit a statement of explanation.

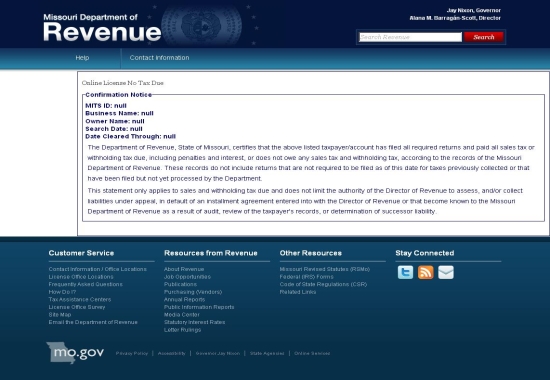

. Once the form is completed and signed by a corporate officer it can be mailed or faxed to the tax clearance unit. The letter verifies that there is no need of registration for salesuse tax because you are not going to make taxable sales in Missouri. If the business is properly registered and does not owe any Missouri sales or withholding tax this site will allow you to print your own Certificate of No Tax Due which you can present to the local or state agency.

Receive this information Title. If you are requesting a No Tax Due use No Tax Due Request Form 5522. File a Vendors Use Tax Return - Contact Information.

Missouri vendor no tax due certificate. The state of Missouri provides you a vendor no tax due certificate if you do not provide taxable services or sell tangible personal property at retail. In order for the business owner or authorized representative to obtain a no tax due through the online system the business must.

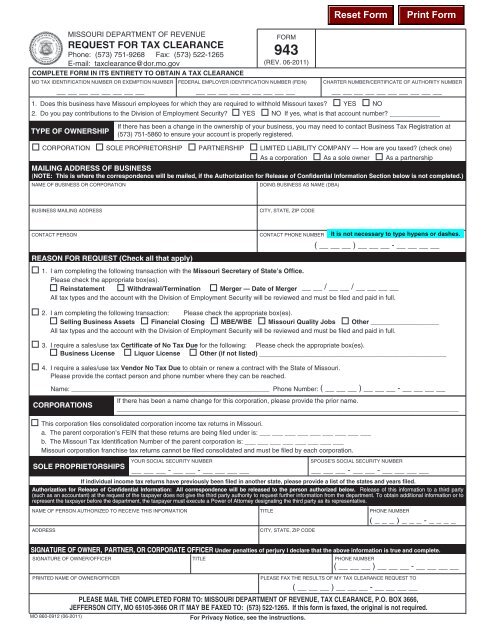

The federal government imposes excise taxes on various types of business activities. A Vendor No Tax Due certificate can be obtained by completing and submitting the Request For Tax Clearance Form 943 to the Missouri Department of Revenue Division of Taxation Collection. Lease agreement or deed for the office location.

To obtain or renew a contract with the state of missouri. If you need a No Tax Due Certificate for any other reason you can contact the Tax Clearance Unit at 573 751-9268. If a city county or state agency has enrolledwith the Missouri Department of Revenue they will be able to determine if a business has no tax due without requiring a piece of paper to be issued by the Department of Revenue.

Select all that apply. The Vendor No Tax Due Letter is not acceptable for this item. A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and Exemption Section at 573-751-2836 or salestaxexemptionsdormogov to request a Certificate of No Tax Due.

Please enter your MOID and PIN below in order to obtain a statement of No Tax Due. If you have questions concerning reinstatements please contact the. Obtain a vendor no tax due certificate from the missouri department of revenue by following the procedures outlined below.

I require a sales or use tax Certificate of No Tax Due for the following. I require a sales or use tax Vendor No Tax Due to obtain or renew a contract with the state of Missouri. Mail Fax Taxation Division.

Have a valid registration with the Missouri. The individual must be authorized to discuss the confidential information provided in the return. Make sure you check item.

If you need. A Certificate of No Tax Due is NOT sufficient. Missouri Department Of Revenue document.

Tax Clearance please fill out a Request for Tax Clearance Form 943. The state of Missouri provides you a vendor no tax due certificate if you do not provide taxable services or sell tangible personal property at retail. I require a sales or use tax Certificate of No Tax Due for the following.

The legal business name and MO EIN number must be PREPRINTED on the document by the MO Department Of Revenue. Current Vendor No Tax Due letter from the Missouri Department of Revenue. A corporation must file Form 1120 Declaration of Estimated Tax with the Missouri Deptartment of Revenue search at dormogovforms opens in new window and Form 1120 Federal Estimated Tax opens in new window with the IRS.

Copy of EVV Electronic Visit Verification or Telephony contract. A Vendor No Tax Due can be obtained by contacting. What is vendor no tax due certificate.

Current Vendor No Tax Due letter from the Missouri Department of Revenue. Reason For No Tax Due. If taxes are due depending on the payment history of the business a cashiers check or money order may be required for payment before a certificate of no tax due can be issued.

R Business License r Liquor License r Other if not listed 4. Select all that apply. This form is available at httpdormogovforms943pdf.

If you have questions concerning the tax clearance please contact the. A Certificate of No Tax Due is NOT sufficient. R Missouri Quality Jobs rOther All tax types and the account with the Division of Employment Security will be reviewed and must be filed and paid in full.

The Missouri Department of Revenue will issue a Vendor No Tax Due when a business is properly registered and has all of its salesuse tax paid in full. If you need a No Tax Due Certificate for any other reason you can contact the Tax Clearance Unit at 573 751-9268. You must provide the contact information for the individual filing this return.

You will only need to provide your contact information once by signing up for a MyTax Missouri account. Missouri Department of Revenue Tax Clearance Unit at 573 751-9268. R Business License r Liquor License r Other if not listed _____ 4.

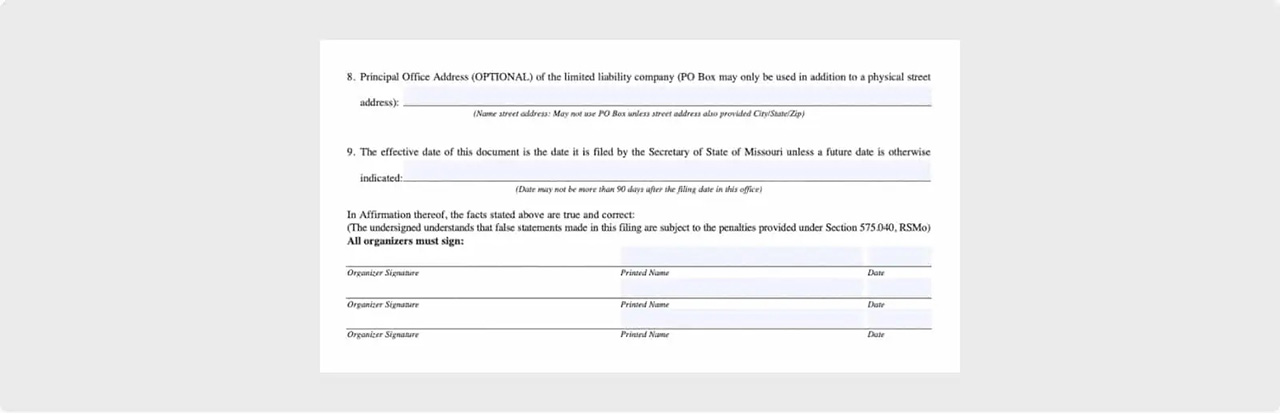

Costs Fees To Form And Operate An Llc In Missouri Simplifyllc

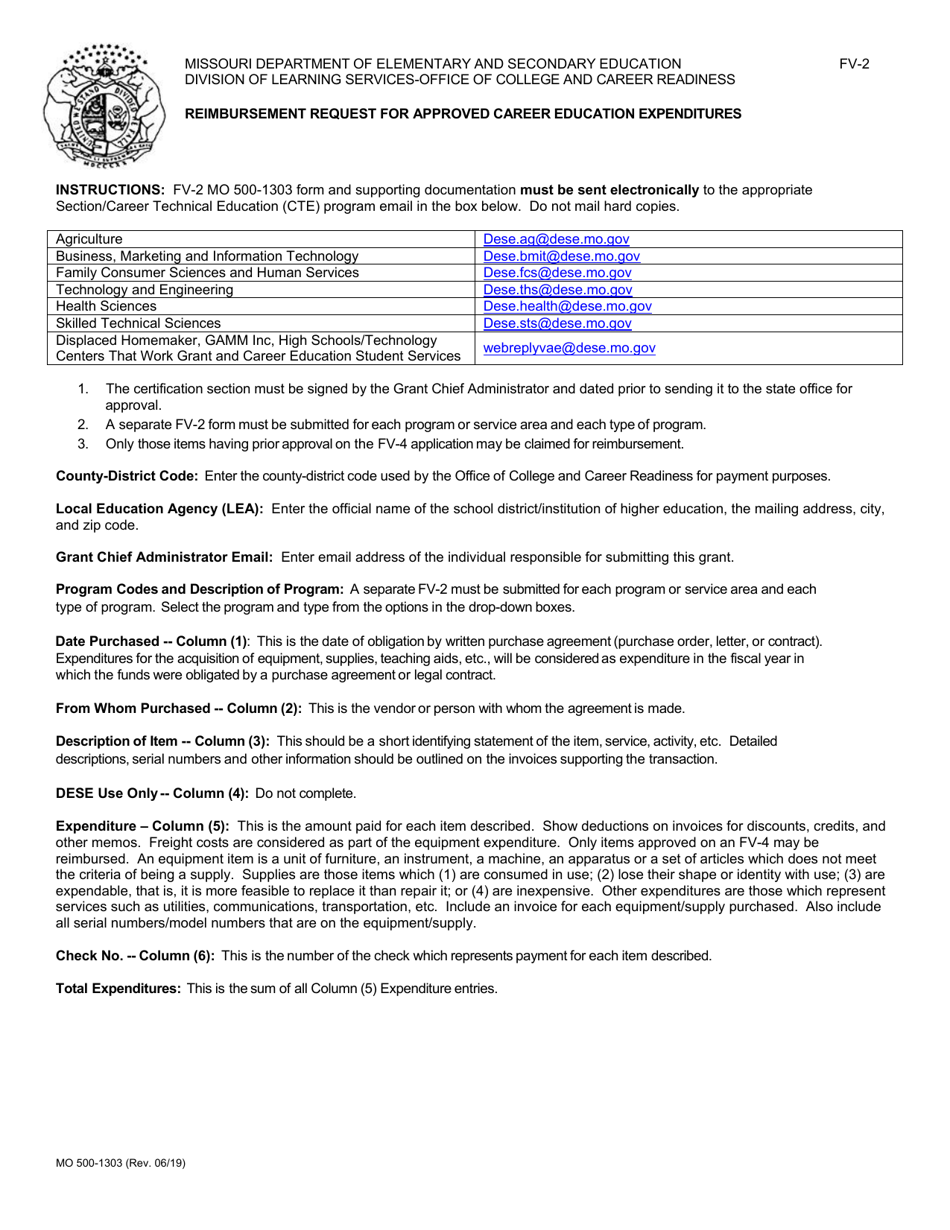

Form Fv 2 Mo500 1303 Download Fillable Pdf Or Fill Online Reimbursement Request For Approved Career Education Expenditures Missouri Templateroller

Best Representation Descriptions Does Walmart Cash Cashiers Checks Related Searches Auto Insurance Claim C Credit Card Design Money Template Payroll Template

March 03 2011 Finance Committee Meeting Agenda Ddrb Financial Meeting Agenda Template Word Agenda Template Meeting Agenda Meeting Agenda Template

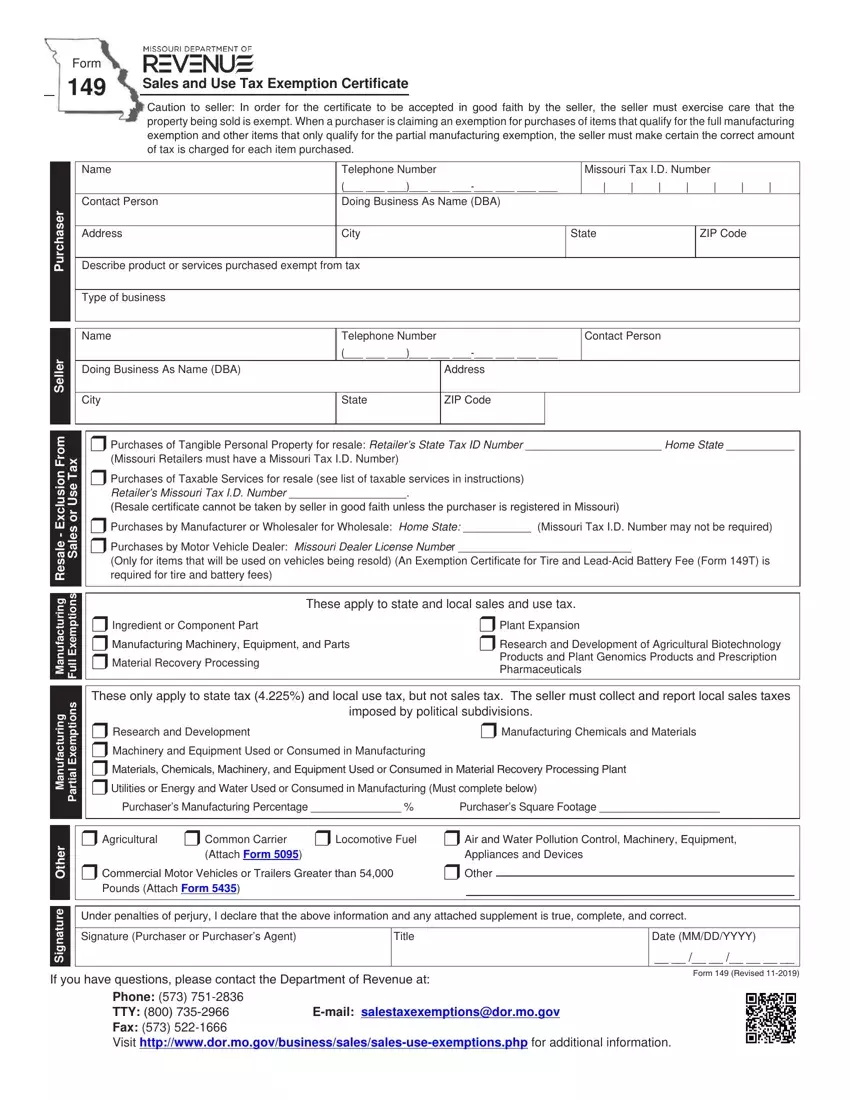

Printable Missouri Sales Tax Exemption Certificates

943 Request For Tax Clearance Missouri Department Of Revenue

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

Missouri Form 149 Fill Out Printable Pdf Forms Online

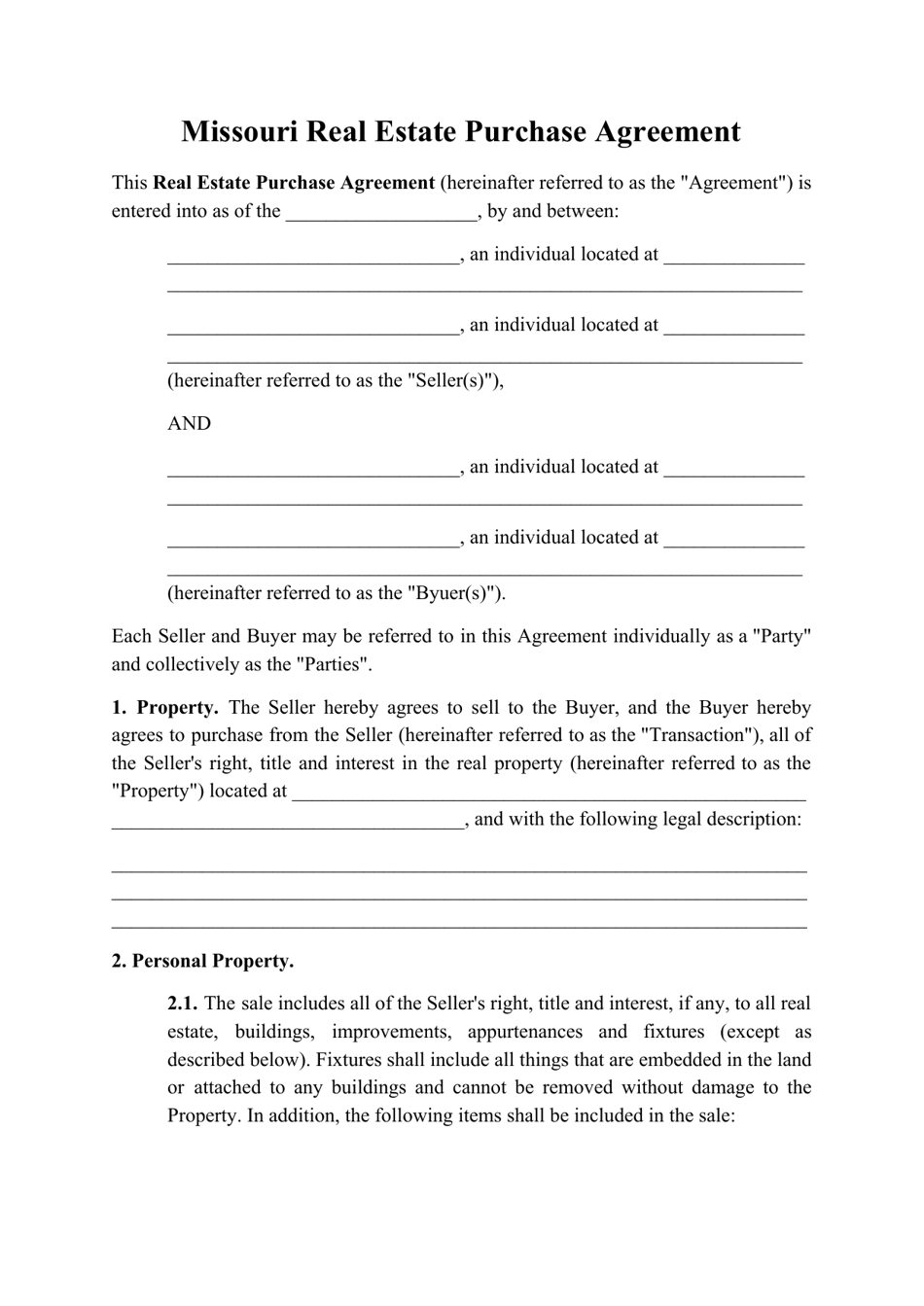

Missouri Real Estate Purchase Agreement Template Download Printable Pdf Templateroller